Investing small amounts of money regularly establishes good savings habits and can benefit you in the long run.

You don’t need a lot of money to start investing. Investing a little every pay period, month, or quarter can develop financial discipline and help you reach your financial goals. Many people think they need to save up a lump sum in order to make a worthwhile investment. In reality, small amounts at regular intervals can be beneficial. When you invest a set amount consistently, no matter what the market is doing, you’re practicing the dollar cost averaging method- an effective way to develop good savings habits and take advantage of market fluctuations.

What is dollar cost averaging and how does it work?

Dollar cost averaging is a common method of investing. People who contribute regularly to retirement accounts are using this method and may not even know it. Dollar cost averaging is the practice of investing a set amount of money at regular intervals, regardless of the price of the shares being bought. You do not need a lot of money to start investing; regularly investing small amounts is a great way to build good savings habits and will likely benefit you in the long run.

In this method, the amount you invest remains the same. As the market fluctuates and the price of shares increases and decreases, the number of shares you are able to buy will fluctuate as well. Over time, the cost of the shares tends to average out. You could end up with more shares for the same amount of money invested as if you had bought a bunch of shares for a lump sum.

This method of investing is used in any type of investment account. Many 401(k) plans use dollar cost averaging automatically by investing contributions every pay period, buying shares consistently over time.*

Let’s see dollar cost averaging at work.

Financial Strategies, Inc.

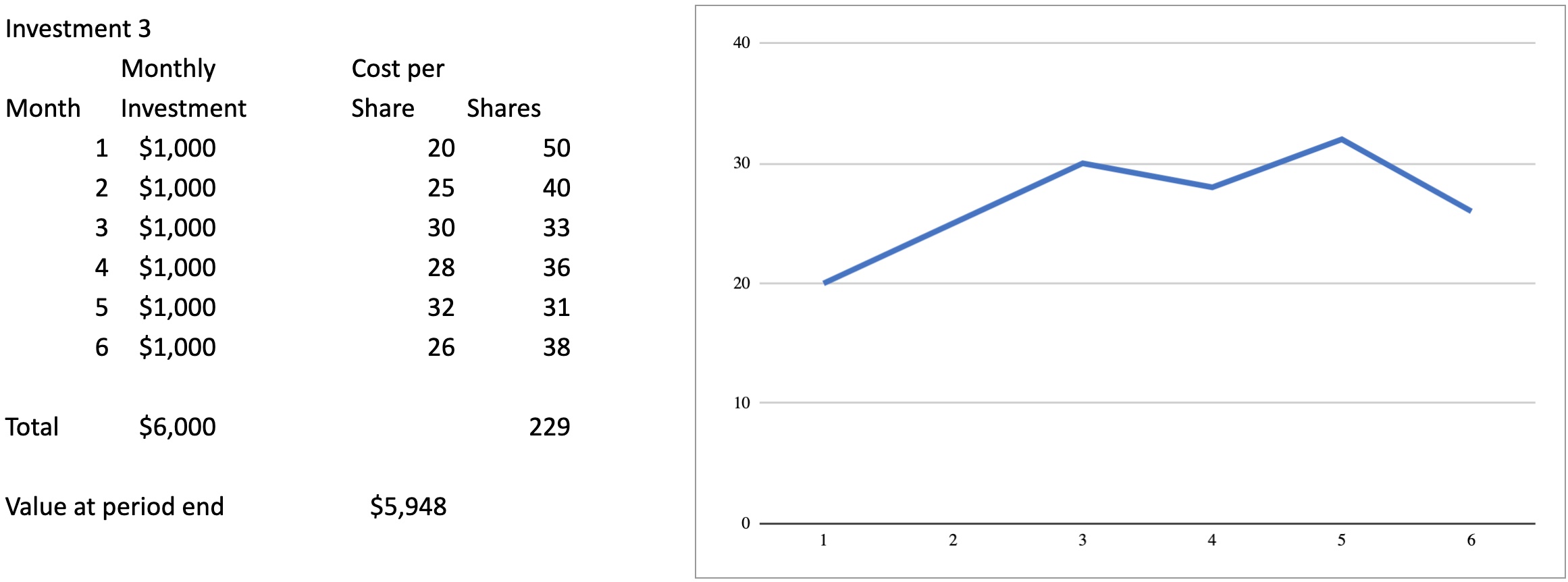

In this scenario, the investor spent $6,000 total and purchased 229 shares. At the end of a six month period the value of the shares is $5,948. However, as this upward trend continues, gains will begin to accumulate and compound. It is important to remember that there is no guarantee that dollar cost averaging will get you more shares for the amount invested, as we see in this first scenario, but it may result in a lower average share price in volatile markets, as we see in the second scenario.

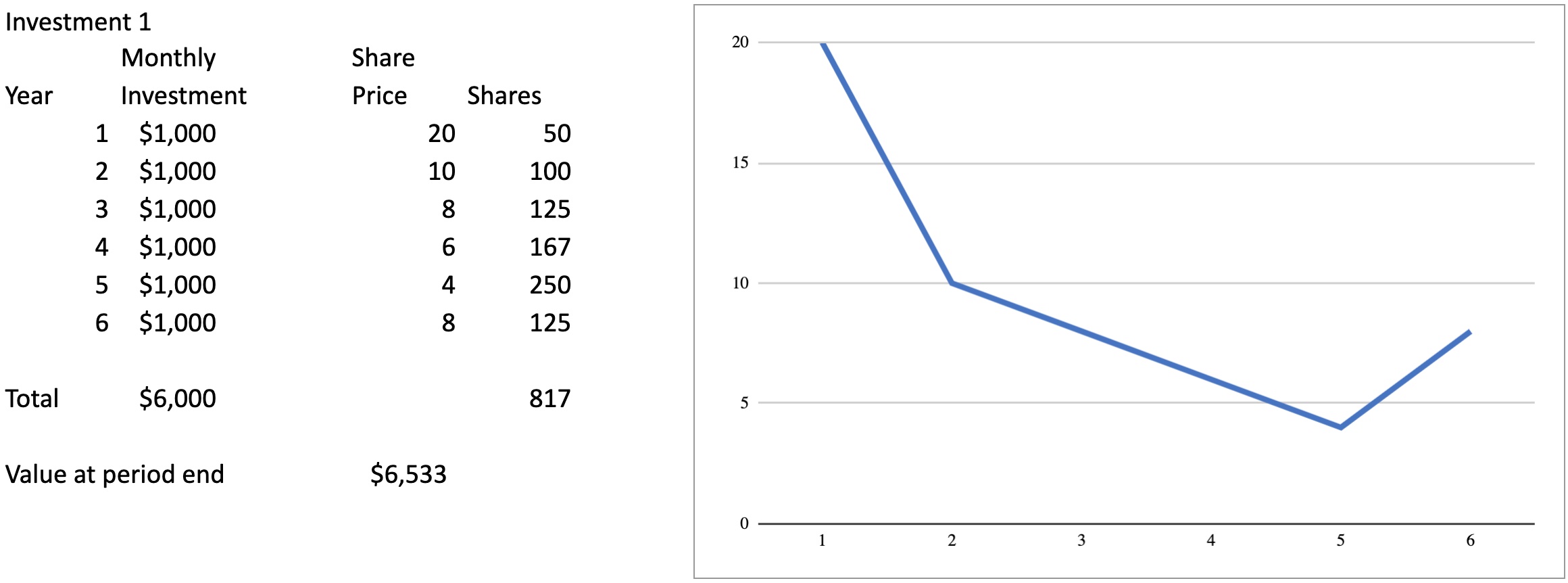

On the flip side, a lot of people get nervous (and reasonably so) when the market starts to tumble. They don’t want to keep losing money on the shares they have bought. The market takes a downturn and stays down for a while, and that’s when they decide to stop investing, or decide to invest in something else that seems like it’s on an upward trend, thinking they’ll make more money.

However, when the market is down it could be a great buying opportunity, because the shares are “at a discount.” Investors are able to buy more shares with the money they’ve chosen to invest. Eventually, the market will likely trend upward again. The shares purchased while it was down will have the highest gains. The disciplined investor will be rewarded.

In this example, the investor put in $6,000 total. He was able to buy 817 shares equalling $6,533 in value at the end of a six month period.

Financial Strategies, Inc.

It may seem scary, but the market taking temporary nose-dives will likely be benefit you in the long run using the dollar cost averaging method.

The above examples are hypothetical scenarios and are included solely for illustrative purposes. They are not to be taken as financial advice.

Risks and benefits of dollar cost averaging.

As with any investment, dollar cost averaging doesn’t guarantee a profit or protect you from losses. It is not a surefire way to end up with more shares for the same investment cost and should not be used instead of a lump sum investment if you have the funds available. We always say “the best time to invest is when you have the money.” Remember, there is no way to predict share prices ahead of time. That is why it is so important to have a disciplined savings strategy and a well rounded, diverse portfolio with many different types of investments.

The main benefit of utilizing this method is to develop good saving habits. Putting a set amount of money aside on a regular basis for investing encourages financial discipline and will likely benefit you long term as you save for retirement.

Another benefit of practicing this method is if you’re investing consistently long-term, you will automatically be taking advantage of the downturns in the market and buying shares when they’re at a discount.

Invest regularly and stay the course.

When the market is down, some people stop buying shares or even cash out because they do not want to lose money on investments that they see as decreasing in value. However, we look at this as an opportunity to buy more shares. Historically, markets have trended upwards over the long-term. Using the dollar cost averaging method is one way to take advantage of fluctuations while developing good investment habits and start setting yourself up for long-term success.

*However, 401Ks often do not automatically rebalance the account. They don’t sell investments that have performed the best and buy those that have underperformed to maintain the intended balance. Account holders usually need to log in and make those adjustments themselves. Most 401k plans have a simple option to rebalance. However, it’s not just a matter of remembering to do it but also deciding when to do it. This doesn’t mean trying to time the markets. It means looking at historical trends strategically and taking advantage of discrepancies. Here at Financial Strategies, Inc. our independent advisors handle rebalancing portfolios, so you don’t have to worry about it.

The above is for informational purposes only and is not to be taken as advice. Please talk to your Fee-only Certified Financial Planner TM Professional before making any investment decisions.